IN THIS LESSON

We will be discussing exactly what the different investment accounts do, why they are used, and what they mean.

What is a Self Managed Investment Account?

A self-managed investing account, often called a self-directed brokerage account, is an investment account where you, the investor, make all the decisions about what to buy, sell, and hold, without a professional financial advisor actively managing the portfolio for you.

You are responsible for the research, analysis, and execution of every trade.

The account you are describing is a flexible type that allows you to invest across a wide range of asset classes.

What are the different accounts that are self managed?

This type of account can be opened as several different account structures:

Taxable Brokerage Account: The most common. There are no contribution limits, but any realized gains (profits) from selling assets are subject to capital gains tax each year.

Retirement Account (IRA, Roth IRA): You manage the investments, but the account is subject to IRS contribution limits and enjoys tax-advantaged growth.

Self-Directed 401(k): Less common, but some employer retirement plans offer a "brokerage window" that allows an employee to self-manage a portion of their funds within the plan.

What is a Roth IRA?

A Roth IRA (Individual Retirement Arrangement) is a tax-advantaged retirement savings account. The key feature of a Roth IRA is its tax treatment:

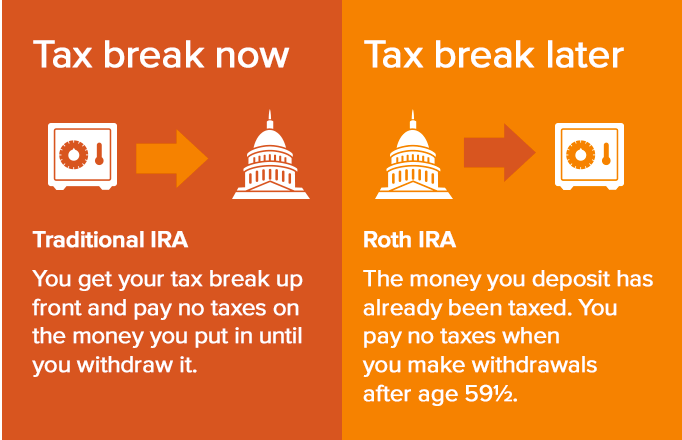

Contributions are Made with After-Tax Dollars: You contribute money that you have already paid income tax on, meaning your contributions are not tax-deductible in the year you make them.

Tax-Free Growth: Your investments within the Roth IRA grow tax-free. You don't pay taxes on interest, dividends, or capital gains each year.

Tax-Free Withdrawals in Retirement: This is the biggest benefit. Qualified withdrawals of both your contributions and your investment earnings are completely free of federal income tax and penalties. To be a qualified withdrawal, you generally must be age 59 1/2 or older and have had the account open for at least five years.

What are the Rules and Key Features of a Roth IRA?

Contribution Limits: The IRS sets an annual maximum contribution limit that applies to all of your IRAs (Roth and Traditional combined). There is also an extra "catch-up" contribution allowed for people age 50 and older.

Income Limits (MAGI): There are Modified Adjusted Gross Income (MAGI) limits that restrict or completely phase out who can contribute to a Roth IRA. If your income is above a certain level, you may not be eligible to contribute.

Withdrawal Flexibility: You can withdraw the original contributions you made to a Roth IRA at any time, for any reason, tax-free and penalty-free. The tax-free rule only applies to the earnings if you meet the qualified distribution requirements (age 59 1/2 and the five-year rule).

No Required Minimum Distributions (RMDs): Unlike a Traditional IRA, the original owner of a Roth IRA is not required to take minimum withdrawals during their lifetime. This allows the money to continue growing tax-free for a longer period and can be a valuable estate planning tool.

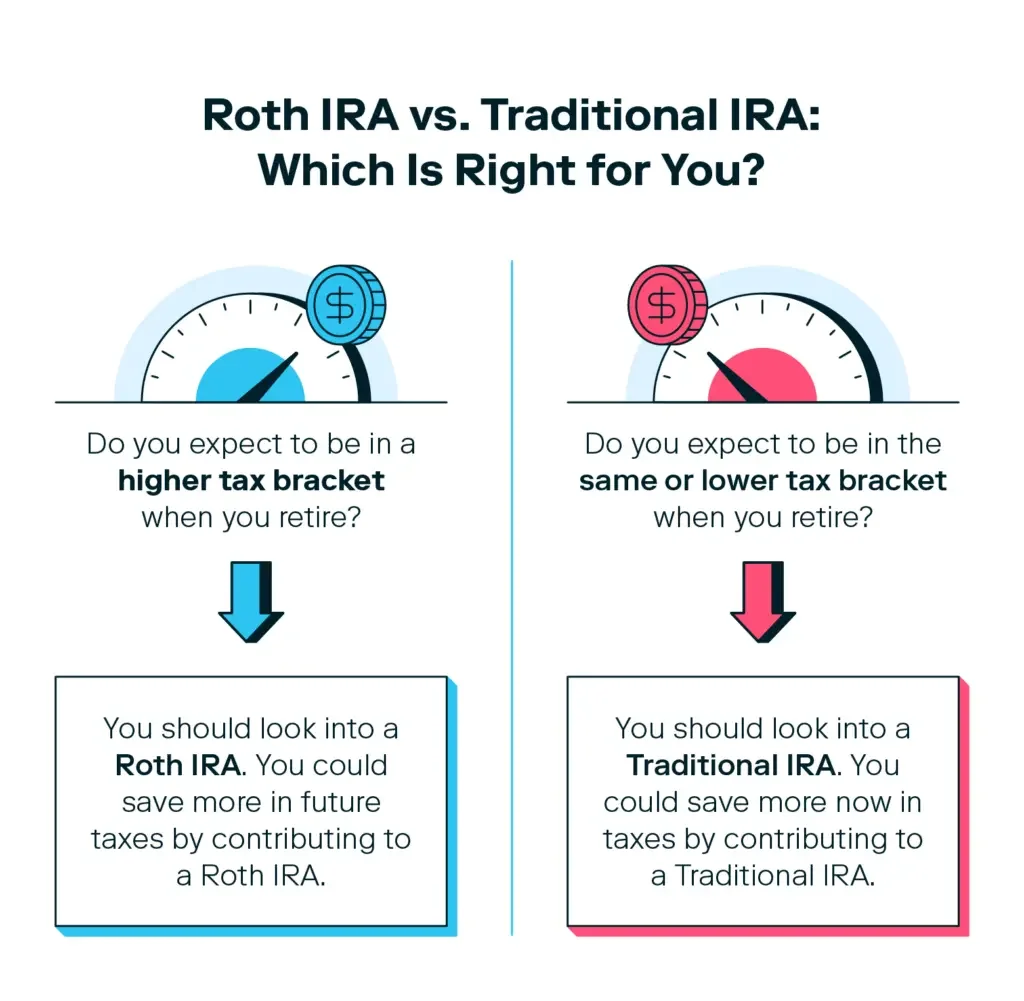

A Roth IRA is often recommended for people who believe they will be in a higher tax bracket in retirement than they are now, as it locks in the tax rate today (by paying taxes on the money upfront) in exchange for tax-free income later.

What is a 401k?

A 401(k) plan is an employer-sponsored retirement savings and investment account that offers significant tax advantages to help employees save for the future.

Here are the key features and how it generally works:

Employer-Sponsored: 401(k) plans are offered by employers to their eligible employees.

Employee Contributions (Elective Deferrals): Employees choose to have a portion of their paycheck automatically deducted and contributed to the plan. These are called "elective deferrals."

Tax Advantages: A 401(k) typically offers two tax options:

Traditional 401(k): Contributions are made with pre-tax dollars, which lowers the employee's taxable income for the current year. The money grows tax-deferred, and withdrawals in retirement are taxed as ordinary income.

Roth 401(k): Contributions are made with after-tax dollars, meaning there is no up-front tax break. However, the money grows tax-free, and qualified withdrawals in retirement are completely tax-free.

Employer Match (Optional): Many employers offer a matching contribution, where they contribute to the employee's account based on how much the employee contributes, up to a certain limit. This is essentially "free money" to the employee.

Investment Growth: The money contributed is invested in various options offered by the plan (like mutual funds, target-date funds, etc.). Earnings on these investments grow tax-deferred (Traditional) or tax-free (Roth).

Vesting: While employee contributions are always 100% owned by the employee (immediately vested), employer matching contributions may be subject to a vesting schedule. This means an employee must work for the company for a certain period before the employer's contributions become fully theirs to keep if they leave the job.

Withdrawal Rules: The money is intended for retirement savings. Withdrawing funds before age 59 1/2 typically results in taxes (for traditional contributions/earnings) and a 10% early withdrawal penalty, though some exceptions apply.